Comptroller General Gene Dodaro’s 15-year term leading the Government Accountability Office will end later this month. Mr. Dodaro’s tenure of public service spans more than 50 years. Few Americans have made more contributions to the federal government, and his leadership has resulted in considerable savings for American taxpayers.

The end of his term begins a process to fill the vacancy: a bipartisan congressional commission recommends a slate of candidates, the president nominates from that list, and the Senate provides advice and consent, including possible rejection.

The process of recommending, nominating, and confirming a new Comptroller General in 1996 and 2008 took about two years, often with irregularities. The upcoming vacancy and looming debate provide an opportunity for Congress—and GAO itself—to reimagine the organization for the twenty-first century.

GAO’s more-than-a-century-long history has involved several transformations. During the twentieth century, the organization’s original focus—auditing government payment vouchers–transitioned into broader financial oversight, program evaluations, and directed work on behalf of Congress. Congress started layering on additional responsibilities. In 1974, Congress directed GAO to police impoundments, and in 1996, it gave GAO a role in reviewing regulations. In the 1990s, GAO faced steep budget cuts and staffing reductions, prompting a new comptroller general, David Walker, to refocus the organization's mission heading into the 2000s—including rebranding the organization to focus on its modern mission of government accountability and delivering a return on investment for American taxpayers in terms of government savings.

Over the past quarter-century, GAO’s work has produced roughly $1.5 trillion in financial benefits for the U.S. government. Over the past 15 years, GAO’s annual reviews of duplication and waste across federal programs have resulted in more than $700 billion in financial benefits. As a trusted, nonpartisan institution within the legislative branch, GAO continues to provide substantial value to lawmakers on Capitol Hill.

Nevertheless, GAO is now at a crossroads. GAO and the current comptroller general have faced increasing opposition from the Trump administration and some congressional Republicans. OMB Director Russ Vought has stated, “We’re not big fans of GAO,” and called the organization "something that shouldn’t exist.” This opposition is primarily due to concerns about GAO’s recent actions related to its congressionally mandated responsibilities under the Impoundment Control Act and the Congressional Review Act.

On Capitol Hill, some members and staff question the usefulness of GAO's reports and recommendations. During the 117th Congress, a bipartisan select committee passed a recommendation that called for a review of congressional satisfaction with GAO’s work. Some evidence indicates that GAO’s work is not having the intended impact. At least a quarter of GAO’s recommendations are routinely ignored. As of December 2025, more than 5,200 open recommendations remain unaddressed. GAO maintains a “high risk list” of “government operations with serious vulnerabilities to fraud, waste, abuse, and mismanagement, or in need of transformation,” which currently includes 37 areas, including nine items identified in the last century. Some question whether GAO is overly cautious in its approach to evaluating federal programs and activities. There is a long-running joke among congressional staff and even GAO employees and alumni that its reports typically include a balanced framing, such as “progress made, challenges remain,” which requires Congress to probe deep into the reports page and footnotes to actually understand potential problems identified through program evaluations.

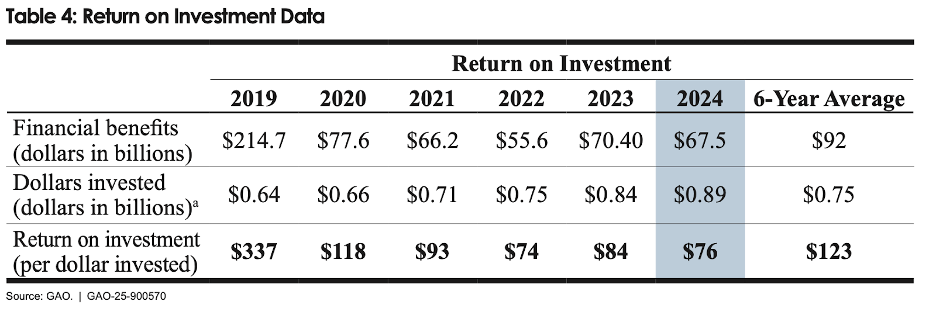

GAO’s own metrics show a declining impact. As of December 2025, GAO’s own performance metrics reveal a recent decline in the organization’s return on investment and in its ability to encourage federal agencies to implement its recommendations promptly between 2019 and 2024. This decline has occurred despite bipartisan reforms enacted by Congress over the past decade to increase GAO’s ROI and effectiveness. Some question whether these trends are linked to GAO’s transition to widespread remote work, which persists today and was codified by a 2023 agreement with its labor union, and to a headquarters building that is often largely empty, according to GAO staff.

The upcoming nomination of a new comptroller general offers a chance to put GAO back on the right track. GAO itself should propose reforms and process changes to address these concerns.

As Congress and President Trump prepare to recommend and nominate the next comptroller general, we recommend the following reforms to strengthen GAO’s effectiveness and value for Congress and the American people.

1. Reaffirm GAO’s core mission and explicitly prioritize fiscal stewardship.

Congress should update GAO’s mission to emphasize its role in supporting congressional oversight, auditing, and program evaluation—centered on identifying opportunities to strengthen federal management and efficiency, reduce improper spending, increase national security, and address the nation’s unsustainable fiscal path. GAO’s statutory charge should explicitly include a forward-looking responsibility to help Congress achieve substantial cost savings and to anticipate and implement long-term fiscal and budgetary reforms.

2. Empower the next comptroller general with authority, autonomy, resources, and a mandate for institutional renewal.

Congress and the White House should jointly select a qualified comptroller general with bipartisan support who is committed to leading GAO into its next chapter, focused on high-impact oversight and fiscal stewardship. This requires strengthening the office’s autonomy in strategic direction, human capital management, and information access, and providing resources to leverage technology and modernize the organization’s oversight approach.

3. Remove politically charged enforcement duties—especially under the Impoundment Control Act—and maintain strict neutrality under the Congressional Review Act.

GAO should no longer serve as Congress’s enforcement arm under the ICA, including the authority to litigate against the executive branch. Congress should either reclaim that authority or establish expedited procedures for congressional enforcement. GAO should also narrow its CRA role to statutory requirements only, refraining from discretionary “observations” that can entangle it in partisan disputes.

4. Direct GAO to focus on high-impact audits and program evaluations, supported by transparent performance metrics and independent review.

Congress should work with GAO to reduce low-impact mandates, authorize the comptroller general to decline specific requests, and strengthen GAO’s capacity to prioritize work with the highest expected fiscal returns or managerial improvements. GAO should institutionalize third-party review (such as by the Congressional Budget Office) of its return on investment estimates.

5. Require GAO to produce more precise and actionable recommendations for Congress and federal agencies.

GAO should establish deadlines for its recommendations for federal agencies. In addition, GAO should include estimates of potential financial benefits and taxpayer savings by enacting recommendations for federal agencies or its matters for congressional consideration. GAO should also develop a recurring line of work modeled on CBO’s “Options for Reducing the Deficit,” including eliminating duplicative or ineffective programs, targeted management improvements, program integrity measures, and deficit-reduction options. These products should identify discrete legislative actions, potential rescissions, and cross-agency reforms—supported by transparent cost-savings estimates and implementation timelines.

6. Strengthen structured collaboration between GAO and Congress and embed GAO expertise within committees.

Congress should integrate GAO personnel into committee work by providing expanded details, with the goal of providing at least one detailed GAO staffer to each committee. Committees should also institutionalize annual oversight hearings focused on significant areas of GAO’s work—such as yearly hearings on open GAO recommendations, high-risk areas, and opportunities to achieve fiscal savings within the committees’ jurisdiction.

7. Establish a statutory requirement for annual comptroller general recommendations on rescissions and fiscal savings opportunities.

Congress should require the Comptroller General to provide annual deficit-reduction and rescissions recommendations to both Congress and the White House. This would give the comptroller general a politically insulated mandate to provide actionable recommendations to the executive and legislative branches to address the nation’s pressing fiscal challenges.

8. Expand GAO’s partnership capacity with federal agencies and state governments to strengthen program integrity and reduce mismanagement.

Congress should provide statutory authority and direct GAO to detail personnel to federal and state agencies to establish federal and state intergovernmental relationships to reduce fraud and improper payments and achieve fiscal savings. In working with state governments, it should offer training and best practices to state audit agencies. GAO should use tools such as the Joint Financial Management Improvement Program to coordinate modern, continuous oversight efforts.

9. Require federal departments and agencies to cooperate with GAO’s oversight and information requests fully.

The White House should issue guidance requiring timely and complete responses to GAO inquiries. Congress should codify strengthened information-access requirements, building on the 2017 GAO Access and Oversight Act. Strengthening cooperation protects GAO’s nonpartisan role and ensures it can deliver credible, high-impact oversight.

10. Expect the next comptroller general to restore bipartisan credibility by avoiding unnecessary political conflict.

While GAO must remain independent, the next comptroller general should proactively avoid actions that insert GAO into partisan disputes unless explicitly required by law. This balancing act—vigorous oversight with disciplined neutrality—is essential to restoring bipartisan trust, reducing political friction, and enabling GAO to focus on high-impact fiscal and management challenges and providing nonpartisan support to Congress to address the nation’s governance challenges.

-----

Throughout GAO’s long history, Congress has recognized the need to review and reform GAO’s mission to meet the times. In 2026, Congress should consider how to focus GAO's work and use its $900 million in annual funding and more than 3,500 employees to meet the needs of the legislative branch and the American people. As Congress and President Trump work to identify, nominate, and confirm the next comptroller general, Congress should hold hearings and reauthorize GAO to update its mission for the twenty-first century.

This post is based on a forthcoming report that will be published in January 2026.