A review of nonpublic data estimating GAO’s financial accomplishments since 2002

In July, the House of Representatives passed the Fiscal Year 2022 Legislative Branch funding bill—legislation that would provide $729 million for the Government Accountability Office, an increase of $68 million over the prior year’s funding level.

The Government Accountability Office (GAO) is Congress’s watchdog: a non-partisan agency with more than 3,100 FTE staff members that conducts independent oversight of the executive branch and provides advice to Congress.

History shows that taxpayer funds spent on GAO are among the best investments that Congress makes. Since the 1990s, GAO has issued annual reports estimating its return-on-investment (ROI) in terms of financial accomplishments achieved based on its nonpartisan oversight. Between 1999 and 2019, GAO has estimated that its work has yielded more than $1.1 trillion financial benefits to the U.S. government and more than 25,000 other government improvements. Since 2012, GAO has reported an ROI of more than $100 in financial benefits for every tax dollar provided to the agency.

In 2020, I reviewed GAO’s annual Performance and Accountability reports between 1999 and 2019 to analyze these financial accomplishments. The report tallied the publicly-reported financial benefits included in each annual report. (During that period, GAO publicly reported approximately $640 billion of the $1.1 trillion in financial benefits estimated.)

In the report, I recommended that GAO should improve the transparency of its ROI estimates by detailing each estimated financial benefit recorded. I also recommended that the Comptroller General provide an annual estimate to Congress of the potential financial savings that could be yielded if all of GAO’s open recommendations were implemented.

In 2021, the House Appropriations Committee’s report accompanying the FY2022 Legislative Branch funding bill includes the following language:

“The Committee is concerned with the potential waste of federal tax dollars due to departments and agencies in the Federal Government not implementing GAO recommendations. The Committee directs that no later than 180 days after enactment of this Act, the Comptroller General shall provide the Committees with a report estimating the financial costs of unimplemented Government Accountability Office recommendations by agency.”

The Government Accountability Office reported that there were 4,718 open recommendations as of August 20, 2021, including more than 500 “priority recommendations” which GAO states “warrant priority attention from head of key departments or agencies because their implementation could save large amounts of money” or yield other significant non-financial benefits.

The FY2022 Legislative Branch funding bill has been referred to the U.S. Senate. If it is passed with the House’s accompanying report language intact, the Congressional appropriations committees will have increased visibility into how much federal departments and agencies could save if all of GAO’s open recommendations were implemented. The Comptroller General’s estimate will likely indicate that the federal government could save tens (if not hundreds) of billions of dollars, though GAO may have difficulty providing a precise estimate.

This article presents an analysis of nonpublic data provided by GAO to Lincoln Network showing all estimated financial accomplishments from 2002 to 2019. GAO provided this data at Lincoln Network’s request as a follow up to my 2020 report. Between 2002 and 2019, GAO recorded 1,679 financial accomplishments totaling more than $1.1 trillion in savings. A public copy of the data table that GAO provided to Lincoln Network is available is below.

https://public.flourish.studio/visualisation/7157530/

An Analysis of GAO’s Financial Accomplishments Between 2002 and 2019

To better understand how GAO’s work yields a return-on-investment for taxpayers, I analyzed the estimated financial accomplishments. The following is an overview of the analysis I conducted. First, I categorized each of the estimated financial benefits by department or agency. In some cases, the financial accomplishment (which is described by GAO in a short phrase) could not be directly attributed to an agency or department. In these instances, I assigned the financial benefit to another category, such as governmentwide, multiagency, miscellaneous, or fraud and abuse.

Table 2 shows a breakdown of GAO’s estimated financial accomplishments by department, agency, or other-assigned category (described above). GAO’s oversight of the Defense Department resulted in nearly $420 billion in estimated financial benefits. Work involving HHS ($185 billion), Treasury ($85 billion), Agriculture ($66 billion), Federal Communications Commission ($57 billion), and HUD ($50 billion) resulted in more than $50 billion in estimated financial benefits to the federal government during this period.

https://public.flourish.studio/visualisation/7157405/

Table 3 shows a breakdown of the number of financial accomplishments recorded for each the twenty-four CFO Act agencies. Oversight of the Department of Defense accounted for more than a third of all the financial accomplishments recorded between 2002 and 2019. GAO’s work involving the Treasury Department, DHS, and HHS resulted in more than one hundred financial accomplishments.

https://public.flourish.studio/visualisation/7157437/

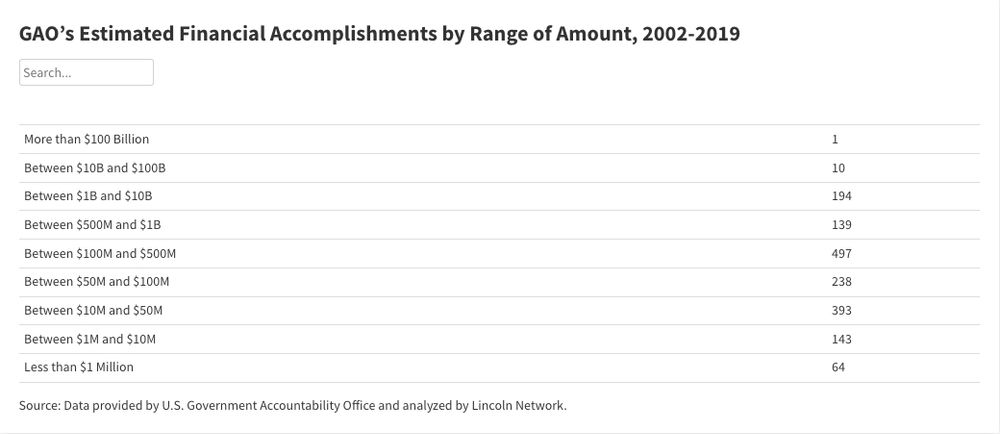

Table 4 presents a breakdown of the size of the financial accomplishments estimated by GAO since 2002. More than 200 of the financial accomplishments resulted in more than $1 billion in savings. More than 630 accomplishments resulted in between $100 million and $1 billion in savings.

https://public.flourish.studio/visualisation/7157468/

An Overview of Currently Open Recommendations by Department

The Government Accountability Office reported that there were 4,718 open recommendations as of August 20, 2021, including more than 500 priority recommendations. The Department of Defense had more than 500 open recommendations, including 55 priority recommendations. Among the other top ten departments that generated the most financial benefits from GAO’s recommendations between 2002 to 2019, there were more than 100 open priority recommendations – HHS (21), Treasury (17), Agriculture (8), HUD (9), Education (2), DHS (13), Energy (22), Labor (6), and State (8).

The Challenge of Estimating Potential Financial Benefits

Based on the financial accomplishments that were estimated between 2002 and 2019, closing the currently open recommendations or “priority recommendations” would likely generate significant cost savings for the federal government. For example, GAO estimated that “tens of billions” of taxpayer funds could be saved if Congress or federal agencies implemented the open recommendations related to its annual work identifying duplication or fragmentation across federal programs.

However, GAO’s Chief Quality Officer told Lincoln Network that it would be challenging for the watchdog agency to estimate potential cost savings that could be achieved if all open recommendations were closed:

“GAO does not estimate the prospective financial benefits of unimplemented or open recommendations. As noted in our performance and accountability reports, GAO relies where possible on estimates from external sources. Other than revenue and cost estimates for proposed legislation that the Joint Committee on Taxation and Congressional Budget Office prepare, comprehensive estimates of potential financial benefits are not readily available. In addition, the variety of approaches that agencies could take to implement recommendations, along with unknown implementation costs that would offset some of the potential financial benefits, make such estimates infeasible.”

Nevertheless, the new report language from the House Appropriations Committee, if approved by the Senate, will require GAO to provide such an estimate. It is possible that GAO could provide estimates based on the past financial accomplishments that have been realized since 2002. The potential value for Congress and federal agencies to improve the efficiency of the government’s operations based on GAO's work justifies an attempt to make such estimates.

Recommendations

Beyond passing the legislative branch funding bill with the unimplemented recommendations report language and fully funding the Comptroller General’s FY2020 budget request, Congress should take the following actions to leverage GAO’s nonpartisan recommendations to improve government operations

Authorizing committees should request the report that the Comptroller General will provide to the appropriations committees. The House Appropriations Committee’s report language only requires the Comptroller General to provide an estimate of the potential savings that can be realized by closing open recommendations to the House and Senate appropriations committees. But other committees would also benefit from this information. For example, the armed services committees should be interested to see the Comptroller General’s estimate given that GAO’s work related to the Department of Defense yielded more than $400 billion in savings between 2002 and 2019. Understanding what financial benefits could be realized by all agencies would inform all authorizing Committee’s legislative and oversight work.

Congress should require the Comptroller General to established recommended deadlines for departments and agencies to implement open recommendations and include estimated financial benefits in each report (where it is appropriate). The Comptroller General’s 2020 Performance and Accountability report explained that 77 percent of its recommendations made in FY2016 had been made after 4 years; however, only 51 percent had been closed after two. In 2015, Deloitte researchers analyzed 26 years of GAO reports and recommendations, including agencies’ responsiveness. They offered recommendations to encourage faster implementation:

“GAO could address this issue by setting target completion dates for implementing each recommendation and then making real-time data available to the public showing how long it is taking each agency to implement GAO recommendations. This could motivate agencies to more quickly address GAO recommendations and realize the benefits they deliver to the public.”

Similarly, requiring each GAO report to estimate the potential financial benefits that could be achieved related to each new recommendation issued would provide further motivation for agencies and Congress to implement them.

Conclusion

The taxpayer dollars that Congress spends on the Government Accountability Office each year generates a large return-on-investment. But additional savings and government improvements could be achieved if agencies implanted all of GAO’s open recommendations and acted on future recommendations in a timely manner. It is time for Congress to leverage its nonpartisan watchdog to achieve more and faster taxpayer savings moving forward.