Five years have passed since Congress responded to the COVID-19 pandemic with unprecedented emergency spending. Today, the crisis is long over, but tens of billions of dollars in federal pandemic relief remain sitting idle in government accounts. As Congress faces new fiscal pressures this fall and a looming government shutdown, lawmakers should return to the model set in 2023 and rescind the remaining unspent COVID-19 funds.

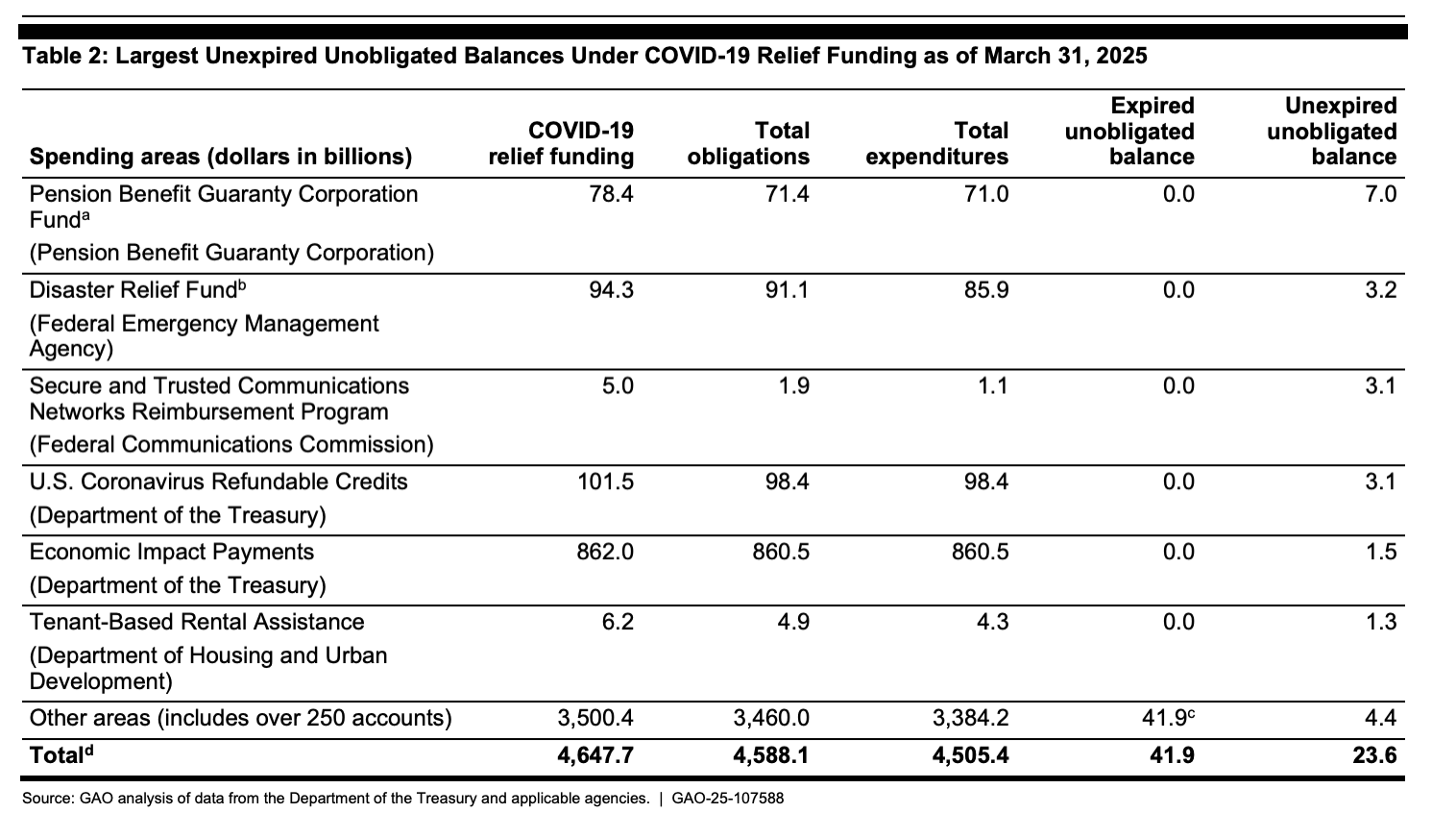

According to a new Government Accountability Office (GAO) report, as of March 2025, approximately $23.6 billion in unexpired, unobligated pandemic relief funding remains available for agencies to spend. While that’s less than 1 percent of the more than $4.6 trillion in total COVID relief, it still represents a significant opportunity for deficit reduction and budget reprioritization. In addition, GAO reported that another $42 billion has expired and is no longer available for obligation. But those funds will remain on the books for several years unless Congress accelerates cancellation or directs those balances back to the Treasury (before the typical five-year timeline for expired, unobligated funds).

Congress could review the different spending programs with unobligated balances and decide what to rescind. For example, the $3.2 billion in the Disaster Relief Fund could be kept, given that Congress routinely provides supplemental spending to this fund following major natural disasters. See, below, GAO’s breakdown of unexpired unobligated balances. The majority of these funds should be returned to the Treasury.

Congress has a clear precedent for action. In 2023, as part of the bipartisan Fiscal Responsibility Act, lawmakers rescinded more than $27 billion in unobligated pandemic-era funds, including emergency public health reserves, unspent small business relief, and unused education funds.

The 2023 rescission package should be a model for today. With the national debt approaching $37 trillion and annual interest payments crowding out discretionary priorities, Congress must look for every available way to restore fiscal discipline. Rescinding unneeded funds—especially those originally designated for temporary COVID-19 emergency use—would be a practical step. It does not involve cuts to active programs, but rather simply removes budget authority that agencies are not using.

Of course, rescinding the remaining $24 billion in pandemic funds will not solve our long-term debt problem. But it’s a meaningful down payment and could create momentum for additional rescission packages and broader fiscal reform. For example, in 2023, the Treasury Department reported nearly $2 trillion in unobligated balances. Reviewing these unspent accounts could identify additional opportunities to achieve savings.

When lawmakers return in September, lawmakers will be focused on federal spending and the need to fund the government for the next year. Rescinding tens of billions of unspent COVID relief funds should be a part of the solution.